Individual Health Insurance

You could save 12% when you buy customized health insurance.

Individual Health Insurance

A contract between an insurer and a policyholder in which the insurer provides medical coverage to the insured up to the sum insured maximum is known as health insurance or medical insurance. There are a variety of health plan features accessible, such as pre- and post-hospitalization coverage, medical check-ups, room rent coverage, cashless facility, and so on.

We are not providing Services to Abu Dhabi.

We are not providing Services to Abu Dhabi.

Top Selling Plans Of Yalla Insure

01

Orient Insurance Co (Basic plan) Nextcare PCP/RN3 starts @523 *AED.

02

Medgulf (Comprehensive plan) Mednet Silkroad starts @1599 *AED.

03

Al Sagr Insurance (Comprehensive plan) Nextcare RN2 starts @2705 *AED.

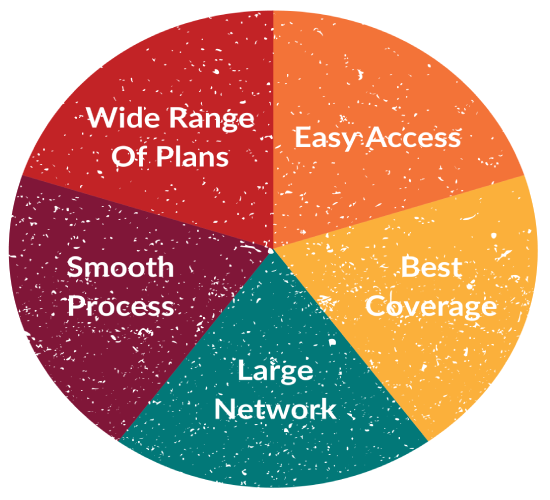

Key Benefits Of Health Insurance Plans In Dubai

01

There is a wide range of plans available for you, your family, and your domestic help.

02

Access eCards, identify network hospitals, examine policy details, and more through an online portal and mobile app.

03

Our coverage and perks start at AED 523* per year and are unrivaled.

04

Purchase process is really convenient both online and offline.

05

We have a large network of over 500 hospitals/clinics and 1,500 pharmacies where we will immediately pay your invoices.

06

Except in Abu Dhabi, where emergencies will be addressed, all emirates will have full coverage.

07

Pre-existing and chronic diseases are covered, and there is no waiting time for people who have previously been insured.

08

There is no co-insurance in the event of an emergency in a medical facility that is not part of your network (within UAE).

Why Choose Health Insurance From Yalla

Super Saving

Compare Quotes from up to 20 Different Insurance

Comfort of Your Home

Simple & Fast Claim Process

Policy Settlement within 2 minutes

Proper Guidance

Types Of Health Insurance In UAE & Dubai

Health Insurance (Basic)

An essential health care coverage plan protects policyholders from any clinical expenditures incurred as a result of a physical problem or illness. These plans pay for care if you or a family member is admitted to an emergency clinic.

Health Insurance That Covers Everything

Wide-ranging health-care coverage provides the most comprehensive protection against clinical costs. The UAE's insurance agencies provide the most comprehensive health-care coverage policies. The best part about comprehensive medical insurance plans is that you may add optical and dental coverage for an additional fee. Pre- and post-hospitalization charges are covered by wide-ranging health-care coverage programmes.

Health Insurance That Is Shariah Compliant

Takaful Insurance is another name for Shariah Compliant Health Insurance. If any part files a claim, the protection sum is paid out of a Shariah Compliant Health Insurance reserve created by several individuals. Individuals choose to contribute to a common asset rather than paying monthly or yearly fees under Shariah Compliant Health Insurance schemes.

Health Insurance With Direct Hospital Access

You do not want to make your hospital expense installment when you get health care coverage with direct admittance to emergency clinics. Here are some of the significant benefits of purchasing health care coverage that includes direct access to emergency clinics.

Best Health Insurance In Dubai

SilkRoad 1 (Comprehensive) by Mednet

Emerald 1 (Comprehensive) by Mednet

Silver (Comprehensive) by Nextcare

Flexi Gold Plan 1 (Comprehensive) by Nextcare

Green Plan 1 (Comprehensive) by Mednet

Health Plus Gold Plan (Comprehensive) by Nextcare

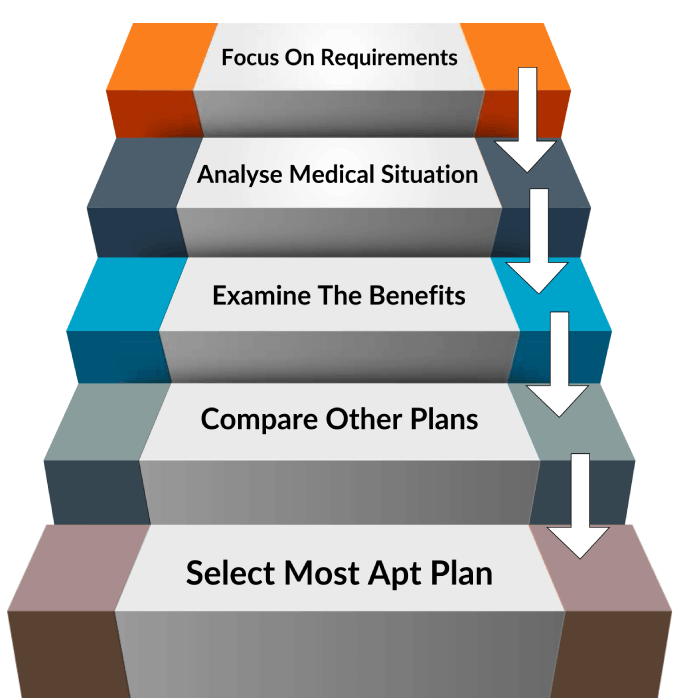

How To Choose Most Accurate Insurance Plan

Find Out What You Require:

The most important thing for you to do is to locate your necessities. You need to figure out what kind of insurance coverage you want and how much protection you can afford on a regular basis.

Analyse Your Medical Situation Right Now:

Then you should break down your illness. For example, if you live a high-tech lifestyle and believe you are more likely to contract a common ailment, you should go for a comprehensive health-care coverage plan. On the other hand, if you are healthy and active and only require standard medications to treat a fever or other medical condition, you can choose a basic medical plan.

Examine The Health-care Benefits:

Make a list of numerous types of health-care coverage plans and their benefits, then choose the one that best meets your clinical needs. If you are unfamiliar with acquiring insurance, you can also call out to protection professionals for assistance.

Examine The Different Insurance Plans:

When choosing a health-care coverage plan, keep in mind items like the insurance installment, the case interaction, the case settlement proportion, the benefits provided, and much more. Make sure you consider all of these factors before making a final decision

Select The Most Beneficial Plan:

After you've narrowed down a few health-care coverage options based on your requirements, choose the one that best suits you. You can also contact the chosen insurance agent and purchase a protection plan.

Comparison Between Different Types of Health Insurance Policies UAE

| Plans | SilkRoad 1 (Comprehensive) by Mednet | Emerald 1 (Comprehensive) by Mednet | Silver (Comprehensive) by Nextcare | Flexi Gold Plan 1 (Comprehensive) by Nextcare | Green Plan 1 (Comprehensive) by Mednet | Health Plus Gold Plan (Comprehensive) by Nextcare |

|---|---|---|---|---|---|---|

| Annual Limit | Covered Coverage Limit :AED150000 | Covered Coverage Limit : AED250000 | Covered Coverage Limit : AED150000 | Covered Coverage Limit : AED250000 | Covered Coverage Limit : AED1000000 | Covered Coverage Limit : AED1000000 |

| Area Of Cover | Worldwide IP : Yes OP : Yes | Worldwide IP : Yes OP : Yes | UAE, ME, GCC, SEA & ISC IP : Yes OP : Yes Restriction: GCC is not covered | UAE, ME, GCC, SEA & ISC IP : Yes OP : Yes Restriction: UAE, GCC, ME, SEA including Indian Subcontinent | Worldwide IP : Yes OP : Yes | Worldwide IP : Yes OP : Yes |

| Coinsurance on OP consultation | Covered Copay: 20% Copay PreAuth: Prio approval required Coverage Limit : AED50 | Covered Copay: 20% Copay PreAuth: Prio approval required Coverage Limit : AED50 | Covered Copay: 20% Copay PreAuth: Prior approval required Coverage Limit : AED50 | Covered Copay: 20% Copay Coverage Limit : AED50 | Covered Copay: 20% Copay PreAuth: Prio approval required Coverage Limit : AED50 | Covered GP: 10% Copay Max AED 25 Specialist: 20% Copay Max AED 60 Copay: 20% Copay Coverage Limit : AED60 |

| Prescribed Drugs & Medicines | Copay: 0% Copay Upto Annual Limit | Copay: 0% Copay Upto Annual Limit | Copay: 0% Copay Upto Annual Limit | Copay: 0% Copay Upto Annual Limit | Copay: 0% Copay Upto Annual Limit | Copay: 15% Copay Upto Annual Limit |

| InPatient Maternity Copay: 0% Copay Upto Annual Limit Restriction: AED 10,000 | Copay: 0% Copay Upto Annual Limit Restriction: AED 10,000 | Copay: 0% Copay Upto Annual Limit Restriction: AED 7,000 for Normal Delivery and AED 10,000 for CSection | Restriction: Covered up to AED 7,000 per normal delivery, AED 10,000 AED for medically necessary Csection, complications and medically necessary termination | Copay: 0% Copay Upto Annual Limit Restriction: AED 10,000 | Copay: 10% Copay Upto Limit: 12500 | |

| Alternative Medicines | Covered upto AED 1,600/. On reimbursement basis only. Restriction: Alternative Medicine Benefit covers: Osteopathy, Chiropractic, Homoeopathy, Acupuncture, Ayurveda and Herbal Treatments | Covered upto AED 1,600/. On reimbursement basis only. Restriction: Alternative Medicine Benefit covers: Osteopathy, Chiropractic, Homoeopathy, Acupuncture, Ayurveda and Herbal Treatments | Not Covered | Not Covered | Covered upto AED 1,600/. On reimbursement basis only. Restriction: Alternative Medicine Benefit covers: Osteopathy, Chiropractic, Homoeopathy, Acupuncture, Ayurveda and Herbal Treatments | Covered up to AED 1,500 Restriction: Alternative Medicines or therapies covered Chiropractic, Osteopathy, Homoeopathy and Ayurvedic |

| Global Emergency Assistant | Covered through Assist America | Covered through Assist America | Not Covered | Not Covered | Covered through Assist America | Not Covered |

Documents Required To Purchase A Health Insurance Plan In UAE

- An application for overseas treatment signed by the applicant,

- A medical report that has been approved,

- A valid passport is required.

- A copy of the ultimate decree or a family book

- A valid identity card from the United Arab Emirates.

- A copy of your health insurance card, if you have one.

Things That Are Covered In A Health Insurance And Things Which Aren't It Entails

01

Medical coverage is provided for childcare operations such as angiography, chemotherapy, dialysis, radiation, hydrocele, and other similar procedures.

02

As a preventive step, you are covered for regular health check-ups.

03

You'll be covered if you need a private ambulance.

04

The costs of organ donation are covered by several comprehensive health insurance plans.

Things That Are Covered In A Health Insurance And Things Which Aren’t It Entails

01

These health insurance plans provide financial protection for your donation.

02

It does not cover plastic or cosmetic surgery: while some of us would be eager to go "under the knife" if we had the funds, an insurance company will not cover the costs.

03

Injury/illness resulting from specifically excluded situations: most insurance policies will have a list of scenarios or specified events that they will not cover the member for, which might include injury resulting from suicide attempts, criminal behaviour, or dangerous activities.

Additional Covers

Maternity Insurance

This cover is invaluable for covering the costs of any pre-conveyance visits and tests, as well as the cost of transportation to welcome your child into the world! For the most part, the strategy also protects your youngster for a short time after delivery.

Dental Cover

Protect your pearly whites with this cover, which will shield your teeth from any essential procedures.

Coverage For Vision

Perhaps you're a scene wearer, or perhaps your eyesight has been influenced by the passage of time or the usage of heavy technology. This topic is the most basic, and it prepares you for an eye exam as well as any recommended focal areas, and it progresses to defined approach limitations.

Factors To Consider Before Buying A Health Insurance / Factors Affecting Health Insurance Decision

Waiting Period

You should purchase a medical coverage strategy with a negligible holding up period. The lower the holding up period, the sooner you will actually want to benefit from inclusion. You should go through the arrangement terms and conditions cautiously and really look at the holding up period prior to purchasing a strategy.

Grace Period

You should purchase a medical coverage strategy that offers the most extreme effortlessness time frame. A greater elegance period gives you more opportunity to restore your arrangement after the due date has passed. You can peruse the approach phrasings to track down the specific elegance time frame accessible under the strategy.

Co-Payment

You ought to decide on a medical coverage plan with no co-installment. Without co-installment, you won't need to make any cash based costs for each case. You can check the approach reports to be aware of any relevant co-installment prior to purchasing the strategy.

No Claim Bonus

You should pick a health care coverage plan with the greatest No Claim Bonus/Cumulative Bonus for each guaranteed free year. The higher is your No Claim Bonus, the higher will be the expansion in your total safeguarded. You should peruse the arrangement archives prior to purchasing to be aware of NCB.

Restore Benefits

You should purchase a medical coverage strategy that offers the most extreme effortlessness time frame. A greater elegance period gives you more opportunity to restore your arrangement after the due date has passed. You can peruse the approach phrasings to track down the specific elegance time frame accessible under the strategy.

Network Hospitals

Network Hospitals allude to the empanelled emergency clinics that have a restriction with an insurance agency to give credit only hospitalisation offices to the guaranteed. On the off chance that the safeguarded gets owned up to the organisation medical clinic of a health care coverage supplier, the clinic therapy bill is paid by the guarantor straightforwardly.

Preventive Health Check-up

You should pick a medical coverage plan that offers free preventive wellbeing examination offices consistently. With this advantage, you don't have to pay for yearly clinical assessments. You can check the arrangement benefits while purchasing to be familiar with preventive wellbeing examination offices.

Sub Limits

You should purchase a health care coverage plan that accompanies no sub-limits. Without sub-limits, you will be allowed to raise a case up to the aggregate protected sum. You can go through the strategy phrasings to learn about any material sub-limits under the wellbeing plan.

FAQ's

What is health insurance and how does it work?

Ans. Health insurance is a type of insurance that pays for a person's medical and surgical expenses in the event of a medical emergency. However, in order to have health insurance, you must pay a premium.

What are the benefits of purchasing health insurance?

How will my health insurance cover my unexpected medical costs?

At what age can you buy health insurance?

Will my health insurance allow me to cover my family?

Can I pay my health insurance premium in installments?

I have been recently diagnosed with a medical condition. Will I be allowed health insurance?

What if I currently have a health insurance policy but wish to increase the amount of money I'm covered for?

I was just diagnosed with a medical problem. Is it possible for me to get health insurance?

Can you tell me what documentation I'll need to obtain health insurance?

What happens if I decide to cancel my health insurance policy after it has been purchased?

Will purchasing health insurance at a young age provide me with greater benefits?

What should I think about before purchasing a health insurance policy?

Is there a limit to how many claims I may submit in a year?

Will my health insurance coverage start on the first day?

What happens if I don't renew my subscription on time?

Is maternity coverage included in most health insurance plans?

Is maternity coverage included in most health insurance plans?

Do I get a discount if I renew my health insurance coverage with the same company?

What is the meaning of a cumulative bonus?

What does "donor expenses" imply?

What is the definition of a pre-existing disease?

If I don't renew my health insurance policy on time, will it expire?

Is it possible to transfer my health insurance policy from one firm to another?

When a claim is submitted, what happens to the policy coverage?

What is the maximum number of claims that can be submitted in a calendar year?

Is COVID-19 treatment covered by my health insurance policy?

What are some frequent health insurance plan exclusions?

In health insurance, what is a network hospital?