Motor Insurance

What Is Motor Insurance ?

Why Choose Car Insurance From Yalla Insure?

Super Saving

Compare Quotes from up to 20 Different Insurance

Comfort of Your Home

Simple & Fast Claim Process

Policy Settlement within 2 minutes

Proper Guidance

When To Buy A Motor Insurance Policy?

If you are planning to buy a new car, you should begin looking for coverage as soon as possible. It's pointless to wait until the very last moment to discover the ideal policy for your needs, as this might take a long time. You'll have more alternatives to pick from if you start early. It's also a good idea to avoid buying the first insurance coverage you find.

Also, bear in mind that before you can finalise the transaction, you'll need to submit all of the facts about your car. However, make sure you have all of your auto insurance information available so you can sign the paperwork as soon as you buy the automobile.

Why Is Buying Car Insurance Important?

The most crucial reason is that it is required by law to get automobile insurance. It compensates you for losses incurred as a result of a car accident, a parking mistake, or any other occurrence that results in vehicle damage. It also protects the Third-party or their property from the obligations incurred. Yalla Car Insurance will cover you in such situations, allowing you to relax and enjoy your lengthy journeys without worry thanks to the policy's features, which differ depending on whether you choose the Third Party, Own Damage, or Comprehensive plan.

Carefully select your plan to ensure that it completely protects your vehicle in the event of an emergency!

Comprehensive Insurance Policy

Third-party Insurance Policy

Amazing Benefits You Can Avail

Car rental service in case of an accident

Free Oman Cover

Protected No Claim discount

Optional agency repair

Emergency medical expenses

Off road cover for 4WD vehicles

Benefits for personal cover in case of an accident

24 hour assistance during motor breakdown

Optional GCC cover

Cover for loss of personal belongings

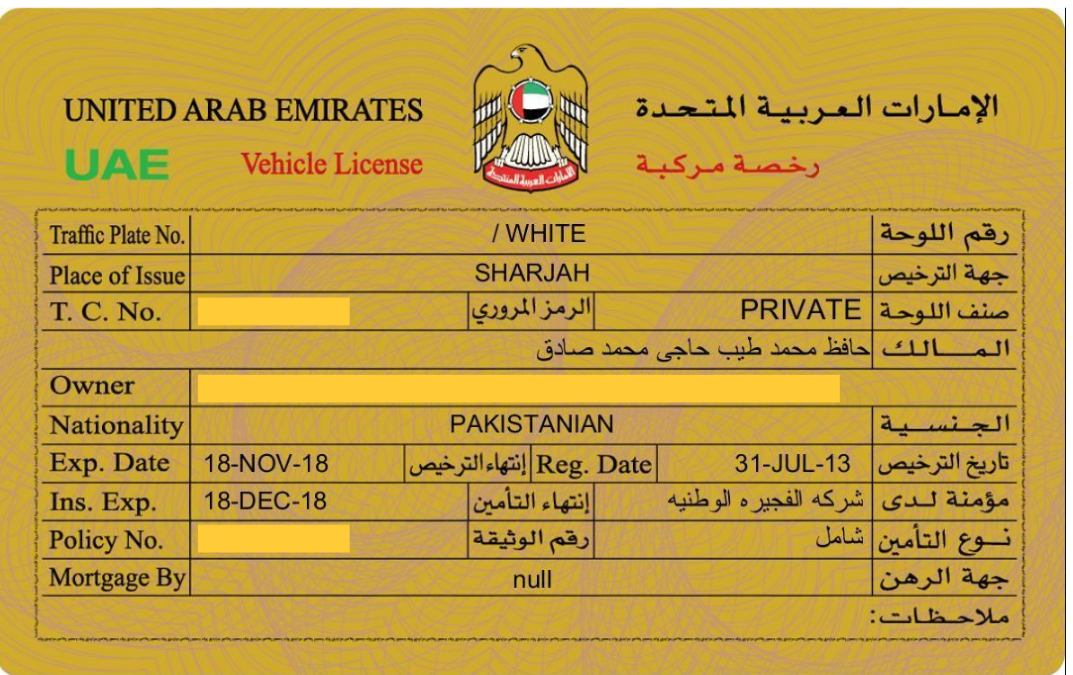

Documents Required For Purchasing & Renewing Automobile Insurance In The United Arab Emirates

Require copy Mulkiya

A copy and original Emirates ID

Number of your previous car protection policy, if you had any

Motor Insurance Premiums In Dubai: What Factors Affect Them

Your auto protection plan's cost is influenced by a number of things. Some are car-related, while others are entirely dependent on the driver. The following are the most important elements that might affect the cost of your automobile insurance:

The Vehicle's Age and Condition

Insuring an motors that is more than ten years old will be more expensive. Older motor are more prone to breakdowns and other problems. This raises the risk that insurance companies take on when providing you with a car insurance policy. This also translates to cheaper Dubai motor insurance for modern cars in excellent condition. The same may be said about older motor that are in horrible shape. If your motor is much less than ten years old yet in poor condition, you could have to pay a higher insurance premium.

Driver's Age

Statistics show that young drivers cause more collisions. When teenage drivers are included in the equation, this results in higher motor insurance rates. Significantly older drivers are also associated with a higher risk of accidents, which can lead to higher vehicle insurance rates. The basic math is that more experienced drivers, who are statistically less likely to cause accidents, pay lower insurance premiums.

The Driver's Driving Record and Habits

In the UAE, having a good driving record will get you savings on your vehicle insurance, whilst having a bad one will swiftly raise your premium. Your vehicle insurance company has access to your driving history. A clean driving record demonstrates that you are a safe driver. As a result, insurance firms are forced to cut their plan prices or give discounts. When you're a high-risk driver, the reverse happens. To manage the increasing degree of risk that vehicle insurance firms take on, insurance companies must raise premium prices. As a result, keeping a clean driving record is one of the greatest methods to obtain the best motor insurance in the UAE.

The Car's Current Market Value

Insurance rates are greater for newer motors with higher market value or price. The reason for this is that insuring an expensive car and paying for repairs costs an insurance company the same amount. Because the insured stated value of the plan will decrease down in tandem with the decreasing market price of the motor, car protection will be substantially cheaper.

Claim History of the Car

If you are the car's second owner, you may need to investigate the vehicle's claim history before purchasing it. Insurance firms may sell the new motor insurance plan at a higher price if the former owner of the motor has made a lot of claims in the past. The more claims you file against a coverage, the higher the insurance provider considers your car to be. This is why, when a claim history is littered with both minor and large claims, the price of insurance coverage rises dramatically.

The Car's Road Accident History

Once again, a vehicle that has been in a number of traffic incidents is more likely to have higher motor insurance prices. The reason for this remains the same: it is classified as a high-risk car by any insurance company. When a car or a driver has a history of accidents or traffic violations, the insurance company considers them a liability. As a result, the premium rises each year when the owner decides to purchase or renew the policy.

Insurance Plan Types and Coverage

Your vehicle insurance rate will be determined by the services and perks you choose, which are unrelated to the motor or the driver-owner. A more comprehensive vehicle insurance plan will cost more than its basic version, as a rule of thumb. Furthermore, if you add a few extras or riders to it, the cost will rise even more.

Deductible

When you pick greater deductibles with your motor insurance in UAE, your premium will be greatly reduced, and vice versa. When a claim against a car protection plan is filed, the deductible is the amount that the policyholder pays out of pocket. After the deductibles have been paid, the insurance provider pays the remaining costs. As a result, insurance firms' risk is reduced, and premiums are reduced as a result.

Discounts and promotions that are currently available

Motor insurance firms, like any other form of business, are constantly running specials and special discounts. Anniversary discounts, festival bonuses, excellent driving discounts, or simple online purchase discounts are just a few examples. Your premium may increase or decrease depending on your score. The easiest approach to discover the best vehicle insurance in Dubai is to look for discounts and thoroughly compare motor insurance quotes before purchasing.

The Motors Insured With Us

Land Rover

Mercedes Benz

Sunny

Ferrari

Corolla